Bid-Ask Spread Definition: In the stock market, the “bid-ask spread” is the difference between the bid price and ask price for a security.

In this guide, you’re going to learn about the bid-ask spread, which is a crucial liquidity metric that should be examined before trading any stock or option (derivative). If you’d like, you can skip to a particular section by clicking on the section title.

Care to watch the video instead? Check it out below!

Jump To

"Bid and "Ask" Explained

Before trading any product in the market, it’s crucial to gauge the hidden cost (in addition to transaction cost) of entering and exiting a position in that product. The bid-ask spread can be used to assess the cost of trading a particular stock or option.

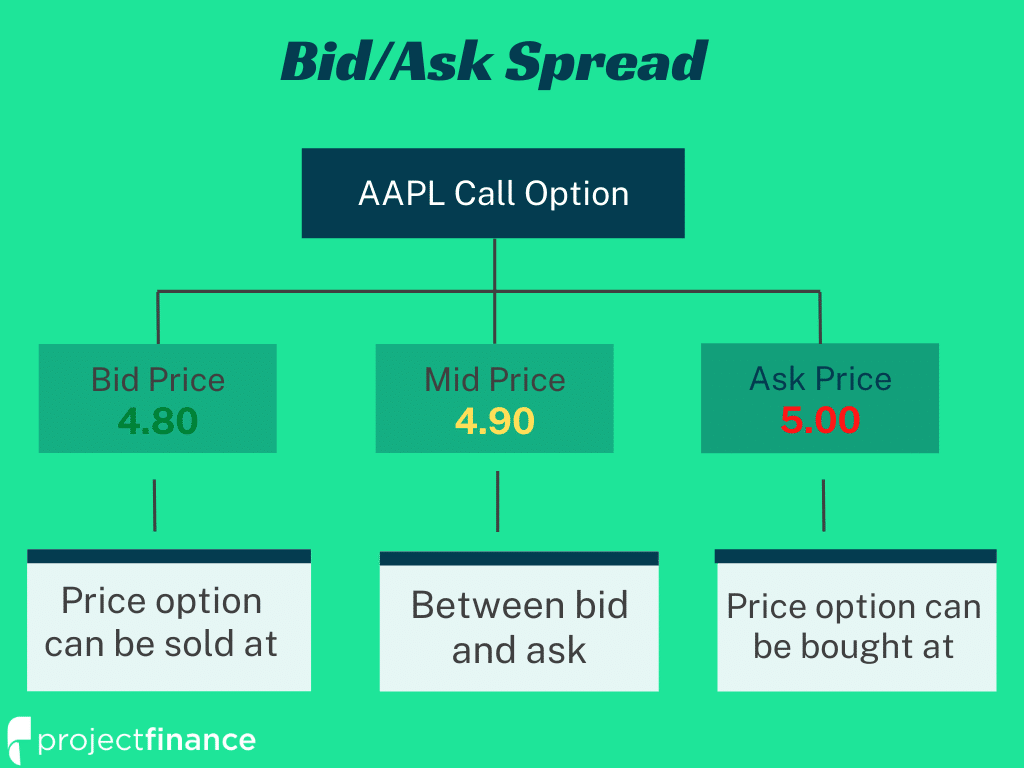

Before discussing the bid-ask spread, we need to talk about what the “bid” and “ask” prices are. The following visual explains what the bid and ask prices represent.

When trading a share of stock or an option, you can get filled on your order immediately if you sell at the bidding price or buy at the asking price. Therefore, the bid-ask spread tells you how much money you would lose if you purchased something at the asking price and sold it at the bidding price (sometimes referred to as “slippage”).

In this case, you’d have to buy at $3.50 or sell at $3.00 to get filled immediately. When purchasing at the ask and selling at the bid (or vice versa), the corresponding loss will be $0.50, which translates to $50 for 100 shares of stock or 1 option contract.

Ideally, you want to lose as little as possible when entering and exiting a position, which means trading products with a narrow bid-ask spread is preferred.

New to options trading? Learn the essential concepts of options trading with our FREE 160+ page Options Trading for Beginners PDF.

Bid and Ask Spread: Market Makers

The function of a market maker is to provide market liquidity. These financial professionals accomplish this by standing ready to both buy the bid price and sell the asking price for the security they specialize in.

They profit from the “spread”, or the difference between the bid and ask price. However, they are obligated to fill you at the best price.

Market makers provide liquidity on particular securities on various stock exchanges, such as the NYSE and the Nasdaq.

Market makers want retail order flow so paid, they are willing to pay brokers for the right to fill their customers orders in a system called payment for order flow.

Bid and Ask Spread Example

As an example, let’s look at some hypothetical bid-ask spreads for various trading products:

If a trader wanted to purchase a share of stock instantly, they would have to pay the asking price of $100.03. To immediately get out of the position, they would have to sell at the bid price of $100.02. As you can see, the loss on this transaction is $0.01 per share (not including commissions). With 100 shares, the loss would be $1 ($0.01 x 100).A $0.01 bid-ask spread is the best-case scenario and is an indication that a product is actively traded.

Now, regarding the call option, the asking price is $1.20 higher than the bid price, which means a trader would lose $120 from just buying the call at the asking price of $6.30 and selling the option at the bidding price of $5.10. Trading products with a bid-ask spread this wide is clearly not advised.

Lastly, the put option has a bid-ask spread of only $0.05, which is considered to be a narrow spread. In the case of buying at the asking price and selling at the bidding price, a trader would only lose $5 per contract.

Spread in Stocks vs. Options

When trading shares of stock, the bid-ask spread will often be a few pennies wide. However, a majority ofstockshave illiquid options with wide bid-ask spreads. So, be more aware of the bid-ask spread when transacting in the option markets, and try to only trade options with bid-ask spreads less than $0.10, as it will save your trading account from “hidden” costs that can accrue to massive amounts over time.

At this point, you know and understand the implications of the bid-ask spread. Next, we’ll quickly discuss which options tend to have the widest bid-ask spreads so you can avoid trouble when trading options.

Which Options Have the Widest Bid-Ask Spreads?

Options with strike prices further away from the stock price typically have wider bid-ask spreads.

To visualize this, we plotted a snapshot of the closing bid-ask spreads for calls and puts on SPY (S&P 500 ETF), which is an ETF that has one of the most actively traded option markets. We used options from early 2022 that had approximately 60 days to expiration:

As we can see here, in-the-money calls and puts have the widest bid-ask spreads (approximately $0.50 for the deep-in-the-money options). The options with the narrowest bid-ask spreads are the at-the-money options (strike prices near $205), and the out-of-the-money options. However, it’s worth noting that the out-of-the-money options have narrower bid-ask spreads because the option prices are cheaper (a $0.05 option couldn’t have a $0.50 bid-ask spread).

Bid-Ask Spreads of Long-Term Options (LEAPS)

Now, let’s look at the bid-ask spread of the same strike prices in the expiration that’s nearest to 365 days to expiration:

Right off the bat,we can see that the at-the-money 365-day options have a bid-ask spread near $0.20. These long-term options are known as “LEAPs”. The same options with 60 days to expiration had bid-ask spreads near $0.05.Regarding the in-the-money options, the bid-ask spread isslightly narrower in the 365-day options, which could be explained by higher trading volume in the long-term in-the-money options. Either way, it’s clear thatthe minimum bid-ask spread is four timeswider in the 365-day options than in the 60-day options.

Spreads vs. Market Volatility

As mentioned previously, bid-ask spreads widen when market volatility picks up. To illustrate this, we plotted the average at-the-money bid-ask spread of SPY options on each day between August 3rd, 2015, and September 18th, 2015. We used the September 2015 expiration cycle:

As we can see, there’s a clear relationship between market volatility (as indicated by the VIX Index) and the bid-ask spreads of options on SPY. While only SPY is used as an example in the visual above, the same concept applies to other stocks in the market as well.

In this example, it’s important to note that the bid-ask spread increased from $0.025 to $0.15 as market volatility increased, but these were the closing bid-ask spreads. When the market opened on August 24th, the bid-ask spreads of SPY options were between $2.00 and $5.00 because the market had opened down 5%. However, the spreads narrowed throughout the day.

So, if you find yourself in a situation where the market is going to open significantly lower than the previous day, expect the bid-ask spreads to be wide in the first couple hours of the trading session.

What Is The Effective Spread?

Generally speaking, the bid and ask prices you see listed for a particular security are not the true market. This is often a wider spread than the true spread. You can often fill trades (particularly option trades) better than the listed market price.

This is because of price improvement.

The below formula (from Wikipedia) shows the equation to compute the “effective spread”.

Option Order Types

There are four primary types of option orders:

- Limit Order

- Market Order

- Stop-Loss Order

- Stop-Limit Order

Limit orders ensure both buy price and sell price, but not execution. These order types are not filled until your “limit price” is reached. To get filled fast, limit orders set at the midpoint are recommended.

Market orders ensure that you will be filled immediately. You will sometimes buy at the lowest ask price and sell at the highest bid price in a market order. These order types are dangerous in options trading, especially in less liquid options.

Stop-loss orders trigger a market order when your stop price is breached.

Stop-limit orders trigger a limit order when your stop price is breached.

Back to Option Basics ➥

Bid-Ask Spread FAQs

Ideally, you want a very tight bid-ask spread. With a wide bid-ask spread, you will forfeit the difference between these two prices when entering and exiting positions.

If an option is bid at 1.20 and offered at 2, you will lose that 0.80 in value when you enter and then later exit the trade. Tight bid-ask spreads make for more efficient markets.

Spreads do indeed count as day trading. The more legs you have in your spread, the more transactions you will have. Day trading spreads in accounts under 25k are not recommended as this is the threshold to become a pattern day trader.

Next Lesson

- Leverage in Options Trading ExplainedDecember 22, 2021

- Intrinsic and Extrinsic Value in Options Trading ExplainedJanuary 6, 2022

- 11 Tips for Options TradersDecember 31, 2021

Additional Resources

About the Author

Chris Butler received his Bachelor’s degree in Finance from DePaul University and has nine years of experience in the financial markets.

Chris started the projectfinance YouTube channel in 2016, which has accumulated over 25 million views from investors globally.

Our Authors

I'm Chris Butler, a seasoned financial professional with a deep understanding of the intricacies of the stock market and trading. With a Bachelor's degree in Finance from DePaul University and nine years of experience in the financial markets, I have actively engaged in analyzing and navigating various aspects of trading, including market liquidity metrics like the bid-ask spread.

Now, let's delve into the concepts discussed in the article about Bid-Ask Spread:

-

Bid-Ask Spread Definition:

- The bid-ask spread is the difference between the bid price and ask price for a security.

- It's a crucial liquidity metric that determines the cost of entering and exiting a position in a particular stock or option.

-

Bid and Ask Explained:

- Bid: The price a buyer is willing to pay for a security.

- Ask: The price a seller is willing to accept for a security.

- Bid-ask spread: It represents the cost of trading a stock or option, calculated by the difference between the bid and ask prices.

-

Market Makers:

- Market makers provide liquidity by standing ready to buy at the bid price and sell at the ask price.

- They profit from the spread, the difference between bid and ask prices.

-

Bid and Ask Spread Example:

- A narrower bid-ask spread is preferable, as it minimizes potential losses.

- Example: A $0.01 bid-ask spread is considered the best-case scenario, indicating an actively traded product.

-

Spread in Stocks vs. Options:

- Options tend to have wider bid-ask spreads compared to stocks.

- It's essential to be cautious and trade options with bid-ask spreads less than $0.10 to avoid hidden costs.

-

Options with Widest Bid-Ask Spreads:

- Options with strike prices further from the stock price typically have wider bid-ask spreads.

- In-the-money options often have wider spreads than at-the-money or out-of-the-money options.

-

Bid-Ask Spreads of Long-Term Options (LEAPS):

- Long-term options (LEAPs) generally have wider bid-ask spreads compared to short-term options.

-

Spreads vs. Market Volatility:

- Bid-ask spreads widen when market volatility increases.

- The example uses SPY options to demonstrate the relationship between market volatility and bid-ask spreads.

-

Effective Spread:

- The bid and ask prices listed for a security may not be the true market.

- The effective spread considers price improvement and can be narrower than the listed spread.

-

Option Order Types:

- Limit Order, Market Order, Stop-Loss Order, Stop-Limit Order.

- Each type serves a specific purpose in options trading.

-

Bid-Ask Spread FAQs:

- A tight bid-ask spread is ideal for more efficient markets.

- Spreads do count as day trades, and wider spreads may result in more significant losses.

In conclusion, understanding bid-ask spreads is crucial for traders to make informed decisions and manage trading costs effectively. Always consider the bid-ask spread, especially in options trading, to optimize your trading strategy and minimize potential losses.